(1) Policy Interpretation

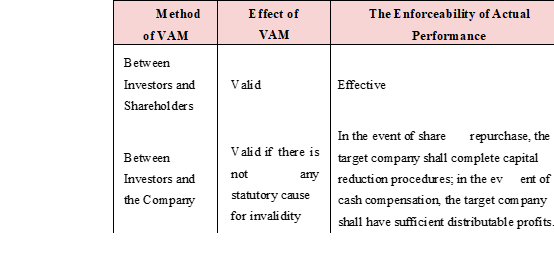

We have discussed the validity of VAM in our May newsletter, which is summarized as follows:

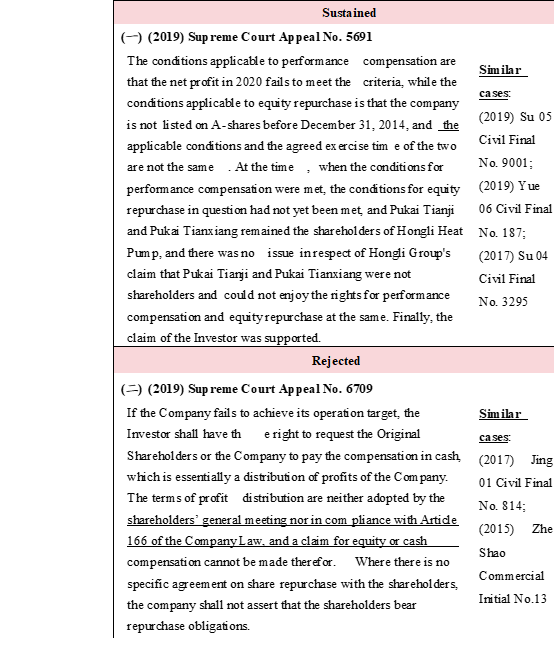

Although the judicial practice has confirmed the legitimacy and validity of VAM at the time of investment, if an investor claims both performance compensation and equity repurchase after investment has been made, whether such arrangement is legitimate and valid or not is not provided in the judicial interpretations or policies such as the Circular of the Supreme People's Court on Issuing the Summaries of the National Conference for the Work of Courts in the Trial of Civil and Commercial Cases (2019, No. 254), which causes disputes in the judicial practice. For example, in the capital increase dispute case between Shandong Hongli Ainiville Environment Technology Group Co., Ltd. and Tianjin Pukaitianji Equity Investment Fund Partnership Company, [Case No.: (2019) Supreme Court Civil Appeal No. 5691; Closing Date: December 24, 2019], the court sustained the claim of the investor who claims both performance compensation and equity repurchase; while in the capital increase dispute case between Guo Yinghui and Chongqing Jingqing Heavy Machinery Co., Ltd. [Case No.: (2019) Supreme Court Civil Appeal No. 6709; Closing Date: December 26, 2019], the similar claim of the investor was not sustained.

(2) Case Dynamics

Ø Focus of Controversy: Can the investor claim performance compensation and equity repurchase against the shareholders at the same time?

In the abovementioned cases, in the sustaining cases, the court mainly considered that performance compensation and equity repurchase are subject to different application conditions and in parallel positions, so the investor is entitled to claim for both at the same time as long as such provisions are valid and effective. Meanwhile, in the rejecting cases, the Supreme Court did not specifically forbid the concurrent claims, but rejected the claim of the investor on the grounds that the performance compensation belongs to profit distribution, but the profit distribution fails to be approved by relevant resolutions and does not meet the relevant provisions of the Company Law.

(3) M&T Notice

We understand that the performance compensation and equity repurchase are financing agreements entered into by the investor and the shareholders of the target company on a voluntary basis and the parties are clearly aware of such arrangements. The agreement shall belong to the scope of autonomy of the parties, and shall be valid provided that it does not violate mandatory provisions of laws and administrative regulations. However, in order to avoid the risk that in practice some courts deem it cannot be claimed at the same time, we suggest that the investment agreement should clearly stipulate that when the performance compensation and equity repurchase conditions are triggered, in addition to the claim against the target company, an investor has the right to claim against the shareholders or actual controller of the target company at the same time.